Star Housing Finance Limited Registers Robust Business Performance, Posts Strong Results For 9m Ending Dec 31, 2022

Mr.Kalpesh Dave, Head, Corporate Strategy, Star HFL REGISTER 545% Y-O-Y INCREASE IN PAT. NETWORTH CROSSES RS. 100 CRS. BONUS AND SUBDIVISION / SPLIT OF SHARES EFFECTED THEREBY REWARDING SHAREHOLDERS New Delhi (India), January 26: STAR Housing Finance Limited (Star HFL), a BSE listed (BSE Scrip code BOM: 539017) rural home finance company has continued its growth […]

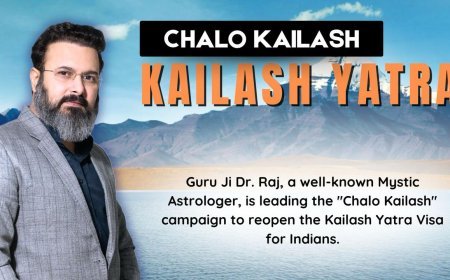

Mr.Kalpesh Dave, Head, Corporate Strategy, Star HFL

REGISTER 545% Y-O-Y INCREASE IN PAT. NETWORTH CROSSES RS. 100 CRS. BONUS AND SUBDIVISION / SPLIT OF SHARES EFFECTED THEREBY REWARDING SHAREHOLDERS

New Delhi (India), January 26: STAR Housing Finance Limited (Star HFL), a BSE listed (BSE Scrip code BOM: 539017) rural home finance company has continued its growth momentum moving into the second half of FY2022-23. This is reflected in strong Q3 performance and resultant record financial results for 9M ending Dec 31, 2022. The board of directors of Star HFL have today approved these financial results and now Star HFL has entered the last quarter of the FY carrying the same momentum forward.

Operational and Financial Highlights:

Top Line Growth: Total income comprising of Interest Income and Other Income has registered 80% y-o-y growth for 9M ending Dec 31, 2022.

Bottom line growth: Star HFL has registered 545% y-o-y growth on PAT for 9M ending Dec 31, 2022 and is now well poised to generate meaningful ROA and ROE for shareholders as the book builds and income gets booked for the entire period from hereon.

Record Disbursement: Star HFL has disbursed Rs.100+ crs disbursement for the first time in a financial year with one more quarter to go by. The Company has registered 466% y-o-y growth in disbursements for 9M FY2023.

Geographical Presence: Star HFL has a diversified presence across western and southern India through 20 semi-urban / rural locations covering over 40 districts and staffed by 135+ employees with registered / corporate office in Mumbai.

Well Capitalised: Star HFL is now a Rs. 100 crs net-worth company. This milestone has been achieved with 3 rounds of successful capital raise over the last 12 business months. Reputed professionals from BFSI space, Capital Market space, FPI and Family Office have participated in its capital infusion journey and now are part of the ecosystem of 7000+ shareholders.

Bonus and Split effected: With 1:1 bonus and 1:2 split effected; the existing shareholders have been rewarded by this corporate action with an objective to create long-term & sustainable value for stakeholders.

ESOP I to be exercised: ESOP I scheme for eligible employees is now set to get exercised, a move aimed at creating ownership, accountability and value creation for employees post all necessary approvals.

Liability continues to scale-up: Star HFL has received credit lines from SBI, Sundaram HFL, MAS Rural, Maanaveeya Development Finance and ICICI Bank during Q3 and has strong funding pipeline through relationships with Banks and FIs to complement the AUM growth. Star HFL continues to have strong relationship with the National Housing Bank for refinance facilities.

Build-up of quality loan book –PAR has reduced from 19% in Mar 2022 to 7.10% as of Dec 2022. This has been achieved given implementation of a robust receivable management framework across operational centers. Live accounts are continuously monitored by the receivable management team and the BIU unit throws any exception that may arise in the overall health of the portfolio. Retail portfolio developed post Oct 2019 has 99%+ OTRR. Overall PAR shall get rationalized as the book gets build and monitored

* adjusted post bonus and split

Speaking on the performance of the Company, Mr. Ashish Jain, MD of Star HFL said, “Star HFL started its growth momentum from current FY and this has continued in each of the quarters. This growth is backed by robust processes and guidelines that anchor our day-to-day operations. Quality is of precedence for us, the fact evident in improvement in PAR, GNPA and NNPA metrics. We are now well set to culminate the year with same momentum and look forward to register strong business metrics for the entire year”

Speaking on the performance Mr. Kalpesh Dave, Head Corporate Planning and Strategy at Star HFL said, “Star HFL has built capacity for the scale up that we have seen in the current FY and continues to invest in branch infra, technology and domain for the next phase of growth in FY2023-24. Our strong capitalization levels and moderate leverage levels give us ample headroom to further strengthen liability and build AUM. Utilization of current capacity has resulted in strong bottom line as the unit cost operating metrics is slowly starting to build and the book is generating income for the operating period. We see ROA and ROE start getting build for the stakeholders as we grow profitably from hereon without losing focus on the asset quality.”

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.