SATYA MicroCapital Acquires the Feat of Rs. 3000 Crores Loan Outstanding Portfolio

Giving centre stage to its phenomenal growth, one of the fastest growing MFIs in India, SATYA MicroCapital has crossed several milestones since its inception on 28th October 2016. With a total loan disbursement of Rs. 5900+ crores to its name, SATYA has achieved another feat by attaining Rs. 3000 crores worth of Assets under Management. SATYA MicroCapital celebrating landmark achievement of 3000 Cr. Loan Outstanding Portfolio Headquartered in the capital city of New Delhi, with first loan disbursement at Sikandrabad branch in Bulandshahr district of Uttar Pradesh, SATYA initiated the course of its operational journey in January 2017. Since then, the MFI catalogued a remarkable growth rate, having achieved an Assets under Management (AUM) value of over Rs. 3000 crores. With the foremost and fundamental goal of empowering rural women, both digitally and financially, SATYA has come a long way since its incorporation. A majority of the MFIs portfolio comprises women entrepreneurs from rural and semi-urban areas whom SATYA MicroCapital has rendered financial support for setting up and developing their businesses. Till date, SATYA has its operational services active in more than 40,000 villages across 22 states. Commenting on the company's success, Vivek Tiwari - MD & CEO, SATYA MicroCapital Limited, said, "Striving to stay committed for serving the people at the bottom of the pyramid, in today's tough market, SATYA is able to attain the best possible debt-to-equity ratio fuelled by remarkable efforts and hard work exhibited by our exemplary employees. Their attention to detail at work made it possible for us. Since its establishment, SATYA has been successfully providing financial services to more than 9,00,000 financially marginalised people for the sky-high development of their social and economic prospects. It is certainly a record in MFI Industry wherein an institution has attained such a grand slam within 5 years of its origin." Speaking during the event, Vivek Tiwari also extolled the board of directors and all the esteemed investors who have played a catalytic role in this journey. He also applauded the entire employee base for their unwavering dedication towards the growth of the organization over these past five years. He recounted the challenges that the company faced at the early stages of the business and how they were able to surmount them. SATYA is integrally concentrated towards providing financial services to people generally excluded from traditional banking channels because of their low, irregular and unpredictable income. It aims to set up and boost the provision of easily accessible, cost effective and sustainable financial services to impoverished to build their financial capacity and ability to grow to financial self-sufficiency. In addition to yielding financial aid to unbanked sections of the population, SATYA MicroCapital consistently associates with institutions of the same wavelength to disseminate the importance of digital and financial literacy in rural areas.

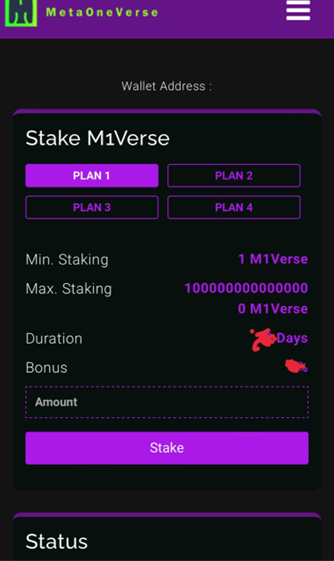

Giving centre stage to its phenomenal growth, one of the fastest growing MFIs in India, SATYA MicroCapital has crossed several milestones since its inception on 28th October 2016. With a total loan disbursement of Rs. 5900+ crores to its name, SATYA has achieved another feat by attaining Rs. 3000 crores worth of Assets under Management.

|

SATYA MicroCapital celebrating landmark achievement of 3000 Cr. Loan Outstanding Portfolio

Headquartered in the capital city of New Delhi, with first loan disbursement at Sikandrabad branch in Bulandshahr district of Uttar Pradesh, SATYA initiated the course of its operational journey in January 2017. Since then, the MFI catalogued a remarkable growth rate, having achieved an Assets under Management (AUM) value of over Rs. 3000 crores.

With the foremost and fundamental goal of empowering rural women, both digitally and financially, SATYA has come a long way since its incorporation. A majority of the MFIs portfolio comprises women entrepreneurs from rural and semi-urban areas whom SATYA MicroCapital has rendered financial support for setting up and developing their businesses. Till date, SATYA has its operational services active in more than 40,000 villages across 22 states.

Commenting on the company's success, Vivek Tiwari - MD & CEO, SATYA MicroCapital Limited, said, "Striving to stay committed for serving the people at the bottom of the pyramid, in today's tough market, SATYA is able to attain the best possible debt-to-equity ratio fuelled by remarkable efforts and hard work exhibited by our exemplary employees. Their attention to detail at work made it possible for us. Since its establishment, SATYA has been successfully providing financial services to more than 9,00,000 financially marginalised people for the sky-high development of their social and economic prospects. It is certainly a record in MFI Industry wherein an institution has attained such a grand slam within 5 years of its origin."

Speaking during the event, Vivek Tiwari also extolled the board of directors and all the esteemed investors who have played a catalytic role in this journey. He also applauded the entire employee base for their unwavering dedication towards the growth of the organization over these past five years. He recounted the challenges that the company faced at the early stages of the business and how they were able to surmount them.

SATYA is integrally concentrated towards providing financial services to people generally excluded from traditional banking channels because of their low, irregular and unpredictable income. It aims to set up and boost the provision of easily accessible, cost effective and sustainable financial services to impoverished to build their financial capacity and ability to grow to financial self-sufficiency. In addition to yielding financial aid to unbanked sections of the population, SATYA MicroCapital consistently associates with institutions of the same wavelength to disseminate the importance of digital and financial literacy in rural areas.

![]()

.jpg)