Paisabazaar Reaches Annualized Rates of Rs. 12,000 Crore Loan Disbursal and Half Million Credit Cards Issued

Digital marketplace for consumer credit and free credit score platform Paisabazaar announced today that it has reached an annualized loan disbursal rate of Rs. 12,000 crore along with an annualized rate of 0.5 million credit cards issued. In Q2 of FY 2022-23, Paisabazaar's disbursals grew by 94% year on year. Number of consumers who have checked their free credit score from the Paisabazaar platform crossed 3.1 crore. In the second quarter of the financial year, around 22 lakh new consumers checked their credit score on Paisabazaar for the first time. Snapshot of Paisabazaars Q2 performance Paisabazaar's stellar growth post the pandemic crisis has been driven by strong focus on digitization, sharp segmentation-led product and process innovations, along with its emerging credit strategy and co-created product initiatives. Since the pandemic in 2020, Paisabazaar has focussed on building its business with strong margins. One of Paisabazaar's key objectives is moving towards profitability; it is aiming to break even in its lending business by the end of this financial year. Naveen Kukreja, Co-founder & CEO, Paisabazaar, says, "Our core focus has always been on providing the best offers to consumers across segments. Today, we are at a vantage point with a deep understanding of the demand and supply dynamics, enabling us to innovate and cover consumer need gaps across the credit spectrum. While we have scaled our business in the prime segment significantly, our emerging credit and co-created initiatives, primarily aimed towards inclusiveness, will be key for long-term growth." Paisabazaar says deep and wide partnerships with Banks, NBFCs and credit bureaus along with a sharp focus on building end-to-end digital capabilities have been its key growth drivers. It runs 15 pre-approved programs with various Banks and NBFCs for loans and cards, enabling better funnels and stronger margins. Paisabazaar has also built end-to-end digital journeys with 10 lending partners with more in the pipeline. End-to-end digital transactions on the Paisabazaar platform have grown by 8.7X since the first quarter of FY 2022. Over 70% of credit cards issued through Paisabazaar currently are sourced completely digitally. Over the next few months, it plans to continue strengthening its digital capabilities and deepening integration with partners. Paisabazaar is also using its strong partnerships across the ecosystem and digitization capabilities to serve large under-served consumer segments through its emerging credit strategy. These large segments typically face challenges in accessing credit due to high rejection rates, low supply and unviable and cumbersome physical processes. Paisabazaar aims to address these challenges by increasing product options and expanding supply, along with bringing in more digitization to the processes. Products on the Paisabazaar platform like short-term personal loans and an exclusive co-created secured card called "Step UP Credit Card" aims to do just that, by helping credit-starved segments access credit and climb up the credit ladder. Paisabazaar has also built a Credit+ program for consumers with damaged credit, which includes a personalized credit advisory services to help consumers build a healthy credit profile, an insightful credit report called Credit Health Report and a credit builder product in Step UP Credit Card. All products and services under the emerging credit strategy are completely digital. Paisabazaar is also strongly focussed on building its co-created product portfolio that aims to cover existing supply, product or process gaps within the lending ecosystem. It launched three exclusive co-created products built with SBM Bank, IDFC First Bank and RBL Bank. This year, Paisabazaar has launched two more exclusive co-created personal loan products this year with a Bank and a NBFC. "Digitization and new innovative products that address market and inclusiveness gaps will define the next phase of growth for the lending industry. We are closely working with our partners and all stakeholders towards this common goal," added Naveen Kukreja. About Paisabazaar Paisabazaar is Indias largest consumer credit marketplace with a 51.4% market share (based on disbursals in Fiscal 2020, as per Frost & Sullivan). Paisabazaar has 60 partnerships with large banks, large NBFCs, credit bureaus and fintech lenders to offer a wide choice of lending products for consumers on its platform Strong partnerships, built through technology and data integration enables Paisabazaar to offer consumers digital and easy processes and faster disbursals. From application to disbursal, Paisabazaar accompanies the Consumer at each step, providing last-mile assistance such as document collection and assistance until disbursal and advice. Paisabazaar, since 2017, has also been providing consumers access to credit rep

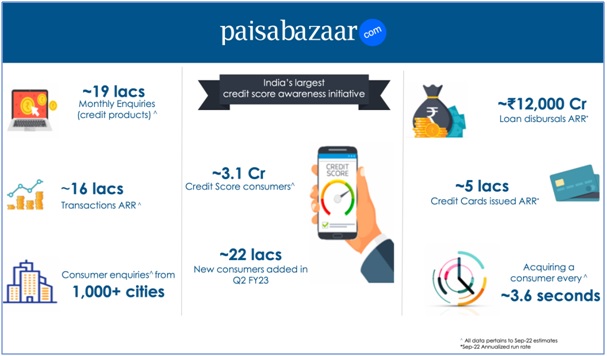

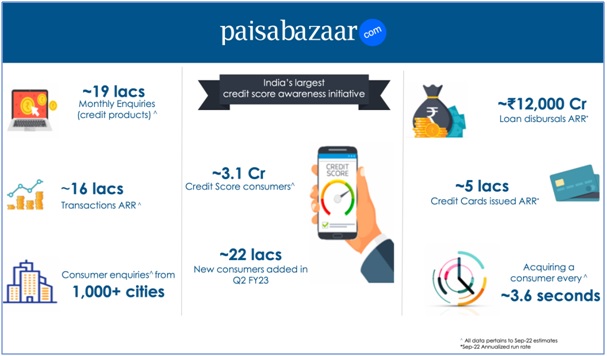

Digital marketplace for consumer credit and free credit score platform Paisabazaar announced today that it has reached an annualized loan disbursal rate of Rs. 12,000 crore along with an annualized rate of 0.5 million credit cards issued. In Q2 of FY 2022-23, Paisabazaar's disbursals grew by 94% year on year.

Number of consumers who have checked their free credit score from the Paisabazaar platform crossed 3.1 crore. In the second quarter of the financial year, around 22 lakh new consumers checked their credit score on Paisabazaar for the first time.

|

Snapshot of Paisabazaars Q2 performance

Paisabazaar's stellar growth post the pandemic crisis has been driven by strong focus on digitization, sharp segmentation-led product and process innovations, along with its emerging credit strategy and co-created product initiatives.

Since the pandemic in 2020, Paisabazaar has focussed on building its business with strong margins. One of Paisabazaar's key objectives is moving towards profitability; it is aiming to break even in its lending business by the end of this financial year.

Naveen Kukreja, Co-founder & CEO, Paisabazaar, says, "Our core focus has always been on providing the best offers to consumers across segments. Today, we are at a vantage point with a deep understanding of the demand and supply dynamics, enabling us to innovate and cover consumer need gaps across the credit spectrum. While we have scaled our business in the prime segment significantly, our emerging credit and co-created initiatives, primarily aimed towards inclusiveness, will be key for long-term growth."

Paisabazaar says deep and wide partnerships with Banks, NBFCs and credit bureaus along with a sharp focus on building end-to-end digital capabilities have been its key growth drivers. It runs 15 pre-approved programs with various Banks and NBFCs for loans and cards, enabling better funnels and stronger margins.

Paisabazaar has also built end-to-end digital journeys with 10 lending partners with more in the pipeline. End-to-end digital transactions on the Paisabazaar platform have grown by 8.7X since the first quarter of FY 2022. Over 70% of credit cards issued through Paisabazaar currently are sourced completely digitally. Over the next few months, it plans to continue strengthening its digital capabilities and deepening integration with partners.

Paisabazaar is also using its strong partnerships across the ecosystem and digitization capabilities to serve large under-served consumer segments through its emerging credit strategy. These large segments typically face challenges in accessing credit due to high rejection rates, low supply and unviable and cumbersome physical processes. Paisabazaar aims to address these challenges by increasing product options and expanding supply, along with bringing in more digitization to the processes.

Products on the Paisabazaar platform like short-term personal loans and an exclusive co-created secured card called "Step UP Credit Card" aims to do just that, by helping credit-starved segments access credit and climb up the credit ladder.

Paisabazaar has also built a Credit+ program for consumers with damaged credit, which includes a personalized credit advisory services to help consumers build a healthy credit profile, an insightful credit report called Credit Health Report and a credit builder product in Step UP Credit Card. All products and services under the emerging credit strategy are completely digital.

Paisabazaar is also strongly focussed on building its co-created product portfolio that aims to cover existing supply, product or process gaps within the lending ecosystem. It launched three exclusive co-created products built with SBM Bank, IDFC First Bank and RBL Bank. This year, Paisabazaar has launched two more exclusive co-created personal loan products this year with a Bank and a NBFC.

"Digitization and new innovative products that address market and inclusiveness gaps will define the next phase of growth for the lending industry. We are closely working with our partners and all stakeholders towards this common goal," added Naveen Kukreja.

About Paisabazaar

Paisabazaar is Indias largest consumer credit marketplace with a 51.4% market share (based on disbursals in Fiscal 2020, as per Frost & Sullivan).

Paisabazaar has 60 partnerships with large banks, large NBFCs, credit bureaus and fintech lenders to offer a wide choice of lending products for consumers on its platform Strong partnerships, built through technology and data integration enables Paisabazaar to offer consumers digital and easy processes and faster disbursals.

From application to disbursal, Paisabazaar accompanies the Consumer at each step, providing last-mile assistance such as document collection and assistance until disbursal and advice.

Paisabazaar, since 2017, has also been providing consumers access to credit reports from credit bureaus, offering Consumers lifetime checking and tracking of their credit scores for free. Over 3 crore consumers have checked their free credit score from Paisabazaar.

Paisabazaar has been recognized at several industry platforms with awards like 'Digital Lending Award' at the Fintech India Innovation Awards, 'Excellence in Consumer Lending' at IAMAI's India Digital Awards, 'Outstanding Crisis Finance Innovation 2021 (Asia Pacific) Award' by Global Finance Magazine, 'Most Innovative Lending Startup' by 'India Fintech Forum and Economic Times' 'Most Promising Brand'.

![]()