Kunal Shah Backed BankSathi Adds 3 Indian languages to Bring Financial Inclusion to India's Hinterlands

BankSathi, Seasoned Investor Kunal Shah-backed Financial Advisory platform has added three new Indian languages to its platform to support and encourage awareness for locals to bolster the growth in the lesser-known financial domain. It gives people great pride to see their language on the app, and they feel like the product is their own. Two more local languages will be added to the application in a future version. This venture will benefit 30 lakh customers and 5 lakh advisors. BankSathi goes multilingual with 3 languages added to newest update The penetration of financial products in India is extremely low. The overall consumer loans as %GDP is 17% while this is 80% in the US and 56% in China. India has only 4.5 active credit cards per 100 people while the US has 337 credit cards and China has 54 Credit cards per 100 people. BankSathi is contributing a big role to provide the right financial product access to underpenetrated billion users. In a country as diverse as India, language is one of the most prominent barriers to financial independence. Among our total 1.4 billion Indians, fewer than half qualify as active internet users, and of those, approximately 500+ million are Indian language users. Interestingly, 70% of these users report difficulty with English and 60% attribute language issues to their inability to adopt online services. We also need to remember that this isn't just about a language barrier. Using financial services also involves jargon and navigating confusing terms and clauses. In order to gain their trust, we cant assume native language speaking customers can grasp these complexities. When handling money, trust is key, and trust is generated by familiarity, comfort, and confidence. To break the language barrier in financial inclusion. as its becoming multilingual, BankSathi customers from tier-2 and beyond can have the comfort of speaking with someone in their own language and understanding fintech products, which may otherwise appear confusing and intimidating. They can now use Telugu, Bengali, and Marathi for accessing accounts, product information, services and many other things through the BankSathi apps. Commenting on the latest development, Jitendra Dhaka, Founder & CEO BankSathi said, "India's soaring ambition rests in its hinterlands. And it is our dear vision to create a truly democratic offering, one that can be accessed by the majority of the Indian population. To the same end, we have gladly added 3 languages to our platform and will continue to introduce new languages with time. By introducing vernacular languages on the platform, we will eliminate language barriers. This is a natural step in our journey to become the one-stop financial advisory platform for the next billion users of India. Our goal is for every Indian to be financially empowered, to have a professional financial advisor, and to take proactive steps towards saving and building wealth." A key driver of BankSathi is the vision of having one adviser for every 100 families, and has trained over 800,000+ financial advisors. Furthermore, BankSathi aims to support 10 million people in starting small businesses. Since BankSathi introduced Hindi as a language option last year, it has recorded a 25% adoption rate. Most BankSathi advisors and customers come from tier-two cities like Jaipur, Chandigarh, and Lucknow, as well as non-Hindi-speaking states like Visakhapatnam, Kochi, and Mysore. About BankSathi BankSathi is becoming India's fastest growing financial advisory platform. At present, it has advisers in 85% of pincodes across the country. Financial advisors include insurance agents, financial analysts, retired bankers, small business owners, as well as anyone interested in supplementing their income. BankSathi has always been focused on providing financial services to the underserved and has been working closely with its clients in India to ensure that the products are accessible to a more diverse set of users. We worked closely with expert linguists to ensure accuracy and authenticity in these new languages. Over full translation, the team chose commonly used words to streamline the buying process. The product team also had a metric-driven approach towards design decisions - they kept their focus on usability and user experience across multiple devices to create a simple yet intuitive interface that users would understand easily. In March 2022, the platform surged more than four- fold. It aims to onboard 20 lakh financial advisors by December 2023.

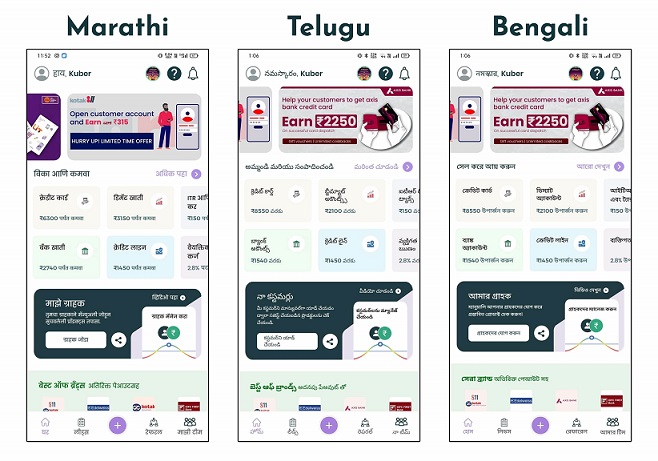

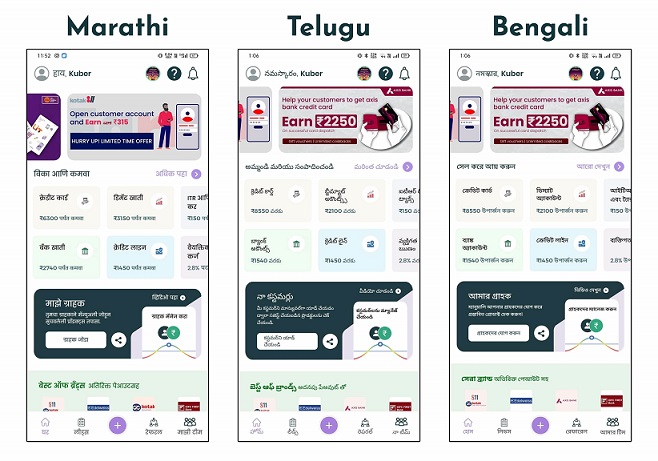

BankSathi, Seasoned Investor Kunal Shah-backed Financial Advisory platform has added three new Indian languages to its platform to support and encourage awareness for locals to bolster the growth in the lesser-known financial domain. It gives people great pride to see their language on the app, and they feel like the product is their own. Two more local languages will be added to the application in a future version. This venture will benefit 30 lakh customers and 5 lakh advisors.

|

BankSathi goes multilingual with 3 languages added to newest update

The penetration of financial products in India is extremely low. The overall consumer loans as %GDP is 17% while this is 80% in the US and 56% in China. India has only 4.5 active credit cards per 100 people while the US has 337 credit cards and China has 54 Credit cards per 100 people. BankSathi is contributing a big role to provide the right financial product access to underpenetrated billion users.

In a country as diverse as India, language is one of the most prominent barriers to financial independence. Among our total 1.4 billion Indians, fewer than half qualify as active internet users, and of those, approximately 500+ million are Indian language users. Interestingly, 70% of these users report difficulty with English and 60% attribute language issues to their inability to adopt online services. We also need to remember that this isn't just about a language barrier. Using financial services also involves jargon and navigating confusing terms and clauses. In order to gain their trust, we cant assume native language speaking customers can grasp these complexities. When handling money, trust is key, and trust is generated by familiarity, comfort, and confidence.

To break the language barrier in financial inclusion. as its becoming multilingual, BankSathi customers from tier-2 and beyond can have the comfort of speaking with someone in their own language and understanding fintech products, which may otherwise appear confusing and intimidating. They can now use Telugu, Bengali, and Marathi for accessing accounts, product information, services and many other things through the BankSathi apps.

Commenting on the latest development, Jitendra Dhaka, Founder & CEO BankSathi said, "India's soaring ambition rests in its hinterlands. And it is our dear vision to create a truly democratic offering, one that can be accessed by the majority of the Indian population. To the same end, we have gladly added 3 languages to our platform and will continue to introduce new languages with time. By introducing vernacular languages on the platform, we will eliminate language barriers. This is a natural step in our journey to become the one-stop financial advisory platform for the next billion users of India. Our goal is for every Indian to be financially empowered, to have a professional financial advisor, and to take proactive steps towards saving and building wealth."

A key driver of BankSathi is the vision of having one adviser for every 100 families, and has trained over 800,000+ financial advisors. Furthermore, BankSathi aims to support 10 million people in starting small businesses. Since BankSathi introduced Hindi as a language option last year, it has recorded a 25% adoption rate. Most BankSathi advisors and customers come from tier-two cities like Jaipur, Chandigarh, and Lucknow, as well as non-Hindi-speaking states like Visakhapatnam, Kochi, and Mysore.

About BankSathi

BankSathi is becoming India's fastest growing financial advisory platform. At present, it has advisers in 85% of pincodes across the country. Financial advisors include insurance agents, financial analysts, retired bankers, small business owners, as well as anyone interested in supplementing their income. BankSathi has always been focused on providing financial services to the underserved and has been working closely with its clients in India to ensure that the products are accessible to a more diverse set of users. We worked closely with expert linguists to ensure accuracy and authenticity in these new languages. Over full translation, the team chose commonly used words to streamline the buying process. The product team also had a metric-driven approach towards design decisions - they kept their focus on usability and user experience across multiple devices to create a simple yet intuitive interface that users would understand easily. In March 2022, the platform surged more than four- fold. It aims to onboard 20 lakh financial advisors by December 2023.

![]()