Firm-visioned Fintechs Paving India's Path Towards Financial Inclusion

A financially empowered India; a vision several Fintechs hold albeit only a handful are vigorously working towards it. Niyogin, a unique early-stage public listed company is striving to empower millions of aspiring individuals and small businesses to transform their dreams into realities through an ecosystem of products, partnerships and exceptional customer experience - all powered by technology. An amalgamation of technology with a focussed mission; Niyogin has strategically built a product and service stack that has the potential to serve a wide range of customers. Its existence is a natural extension of being a facilitator for a new and empowered tomorrow by building a leading 'Neobank' platform infrastructure company with the right mix of products. Niyogin has a customer-centric approach, one that is dedicated to servicing MSMEs and 900 Mn+ rural Indians through technology. It is a holistic platform that delivers solutions for credit, financial inclusion, investments and SaaS services, working in conjunction with a partner-led model that gives affordable access to millions of potential customers. The CEO of Niyogin, Mr. Tashwinder Singh explains the strategic route Niyogin has opted for to empower its audience. As quoted by him, "Niyogin ensures stickiness in three ways - platform integration, platform capability and broadening the product stack. When we onboard a partner, we make sure our infrastructure is deeply integrated with our partner's platform. The Village Level Entrepreneurs who are required to use our solution to deliver the service to rural individuals undergo several hours of training to become more comfortable with the technology. This process is time-consuming and a cost to the partner but ensures seamless product delivery. By ensuring frictionless and high success rates at the time of transactions, our platform not just helps in building trust among rural individuals, but also helps build the trust of our partners in us and our quality of service. Underpinning our commitment, we launched our proprietary switching platform "iswitch" on NPCI's NFS network, in partnership with IndusInd Bank intending to provide a frictionless end-user experience at scale, whilst remaining fully compliant with regulations. We are focussed on building a larger product stack to provide customized solutions and augment network monetization for partners by increasing the prospects to cross-sell." India has actively followed a financial structure where the 'factored in' of the society dominate while the 'factored out' are often excluded and try to make ends meet. Niyogin is devising products and services that are more inclusive in their approach and can benefit the maximum number of people. The constant and thoughtful innovation is paving the way to include the excluded. Having a socially inclusive business that is designed to deliver products and services for all, Niyogin has developed a financial platform that empowers and allows its partners to generate income and provide service/product access to customers across India. It follows a unique, one-of-its-kind partnership model that allows them to touch base with a huge market while enabling income generation and customer acquisition for the partners. Niyogin at a glance Niyogin acquired Moneyfront and iServeU in the year 2019 and 2020, respectively to widen their canvas of offerings. Originally, Niyogin's line of business included several credit modules but with the thirst to empower the society surrounding them, they acquired companies with similar goals. iServeU focuses on Rural Tech and offers a platform that aims to financially empower the 900 Mn+ rural population of India. With noteworthy services like Aadhaar Enabled Payment System, Direct Money Transfer, MicroATM, etc, Niyogin's subsidiary, iServeU, envisages building an inclusive India. On the other hand, Moneyfront, a robo-advisory asset distribution and management firm offers individuals and companies a financial advisory and investment platform. With limited human intervention and affordable advisory services, Moneyfront aims at building a success story of building financial literacy in India. Niyogin Powering Partners Niyogin's service layer includes API integration and SDK integration that helps business correspondents, Kirana stores and financial intermediaries to touch base with rural and urban consumers. While the urban populace has a variety of service providers to choose from, the rural segment is often left underserved and hence, needs the most empowerment. Niyogin Powering Partners Niyogin's platform build is not unique in its design but also in its approach-through its partnership model, it drives income augmentation for partners while serving end customers a chance to realize their dreams with be

A financially empowered India; a vision several Fintechs hold albeit only a handful are vigorously working towards it. Niyogin, a unique early-stage public listed company is striving to empower millions of aspiring individuals and small businesses to transform their dreams into realities through an ecosystem of products, partnerships and exceptional customer experience - all powered by technology.

An amalgamation of technology with a focussed mission; Niyogin has strategically built a product and service stack that has the potential to serve a wide range of customers. Its existence is a natural extension of being a facilitator for a new and empowered tomorrow by building a leading 'Neobank' platform infrastructure company with the right mix of products.

Niyogin has a customer-centric approach, one that is dedicated to servicing MSMEs and 900 Mn+ rural Indians through technology. It is a holistic platform that delivers solutions for credit, financial inclusion, investments and SaaS services, working in conjunction with a partner-led model that gives affordable access to millions of potential customers.

The CEO of Niyogin, Mr. Tashwinder Singh explains the strategic route Niyogin has opted for to empower its audience. As quoted by him, "Niyogin ensures stickiness in three ways - platform integration, platform capability and broadening the product stack. When we onboard a partner, we make sure our infrastructure is deeply integrated with our partner's platform. The Village Level Entrepreneurs who are required to use our solution to deliver the service to rural individuals undergo several hours of training to become more comfortable with the technology. This process is time-consuming and a cost to the partner but ensures seamless product delivery. By ensuring frictionless and high success rates at the time of transactions, our platform not just helps in building trust among rural individuals, but also helps build the trust of our partners in us and our quality of service. Underpinning our commitment, we launched our proprietary switching platform "iswitch" on NPCI's NFS network, in partnership with IndusInd Bank intending to provide a frictionless end-user experience at scale, whilst remaining fully compliant with regulations. We are focussed on building a larger product stack to provide customized solutions and augment network monetization for partners by increasing the prospects to cross-sell."

India has actively followed a financial structure where the 'factored in' of the society dominate while the 'factored out' are often excluded and try to make ends meet. Niyogin is devising products and services that are more inclusive in their approach and can benefit the maximum number of people. The constant and thoughtful innovation is paving the way to include the excluded.

Having a socially inclusive business that is designed to deliver products and services for all, Niyogin has developed a financial platform that empowers and allows its partners to generate income and provide service/product access to customers across India. It follows a unique, one-of-its-kind partnership model that allows them to touch base with a huge market while enabling income generation and customer acquisition for the partners.

|

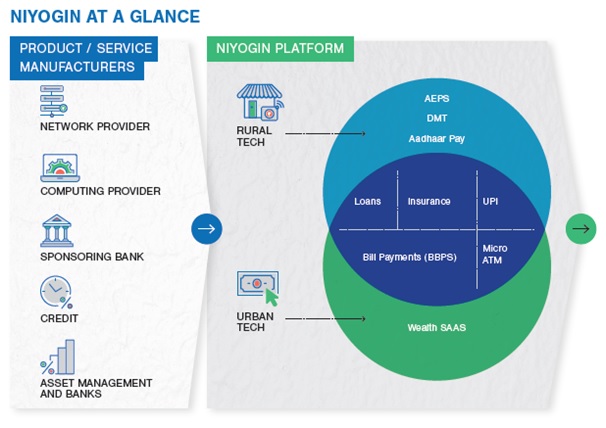

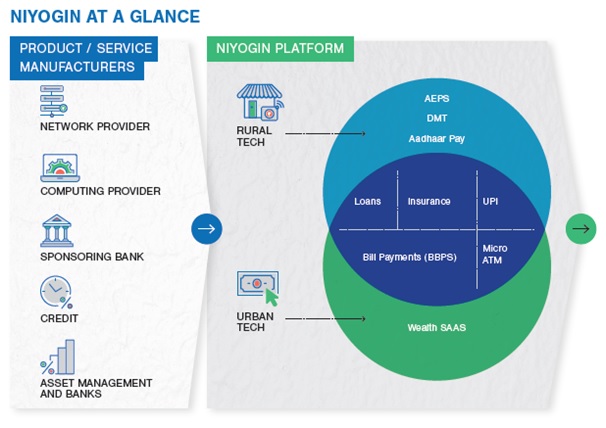

Niyogin at a glance

Niyogin acquired Moneyfront and iServeU in the year 2019 and 2020, respectively to widen their canvas of offerings. Originally, Niyogin's line of business included several credit modules but with the thirst to empower the society surrounding them, they acquired companies with similar goals.

iServeU focuses on Rural Tech and offers a platform that aims to financially empower the 900 Mn+ rural population of India. With noteworthy services like Aadhaar Enabled Payment System, Direct Money Transfer, MicroATM, etc, Niyogin's subsidiary, iServeU, envisages building an inclusive India.

On the other hand, Moneyfront, a robo-advisory asset distribution and management firm offers individuals and companies a financial advisory and investment platform. With limited human intervention and affordable advisory services, Moneyfront aims at building a success story of building financial literacy in India.

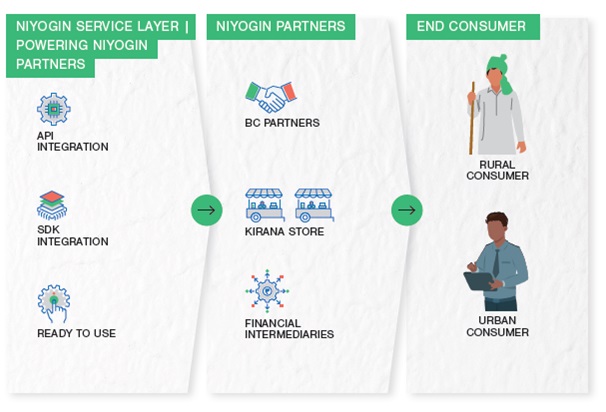

Niyogin Powering Partners

Niyogin's service layer includes API integration and SDK integration that helps business correspondents, Kirana stores and financial intermediaries to touch base with rural and urban consumers. While the urban populace has a variety of service providers to choose from, the rural segment is often left underserved and hence, needs the most empowerment.

|

Niyogin Powering Partners

Niyogin's platform build is not unique in its design but also in its approach-through its partnership model, it drives income augmentation for partners while serving end customers a chance to realize their dreams with best-in-class products and services - A way to empower India!

![]()